Russian Oil and Gas Producers Accelerate Migration to Domestic Digital Platforms

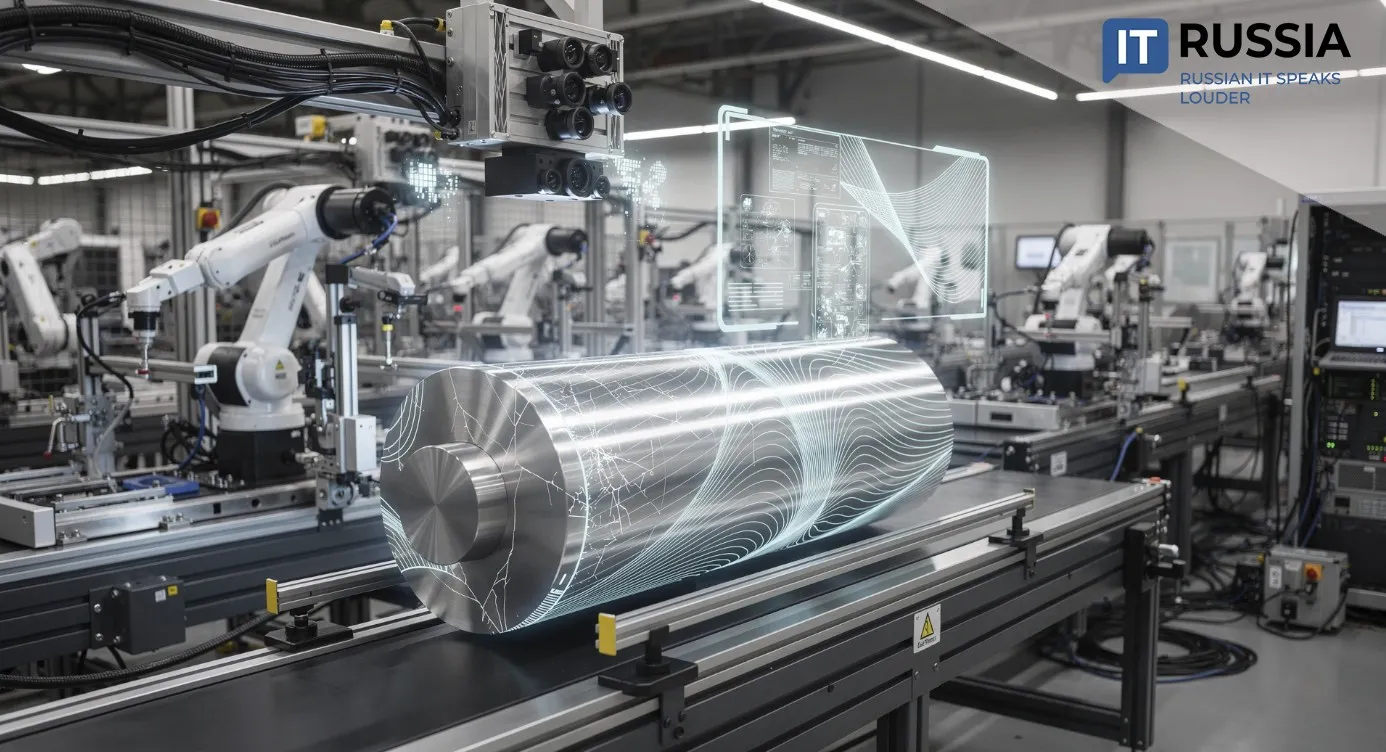

Across Russia’s oil and gas sector, operators are rapidly replacing foreign engineering software with domestic platforms. At the same time, artificial intelligence is moving from pilot initiatives into core production environments, reshaping design, modeling, and asset management workflows.

The Transformation Blueprint

The shift underway is not limited to selective automation. Companies are pursuing systemic digital restructuring of engineering processes, spanning exploration, field development, production operations, and asset management. Sanctions-related restrictions and the need for long-term technological resilience have acted as the primary catalysts.

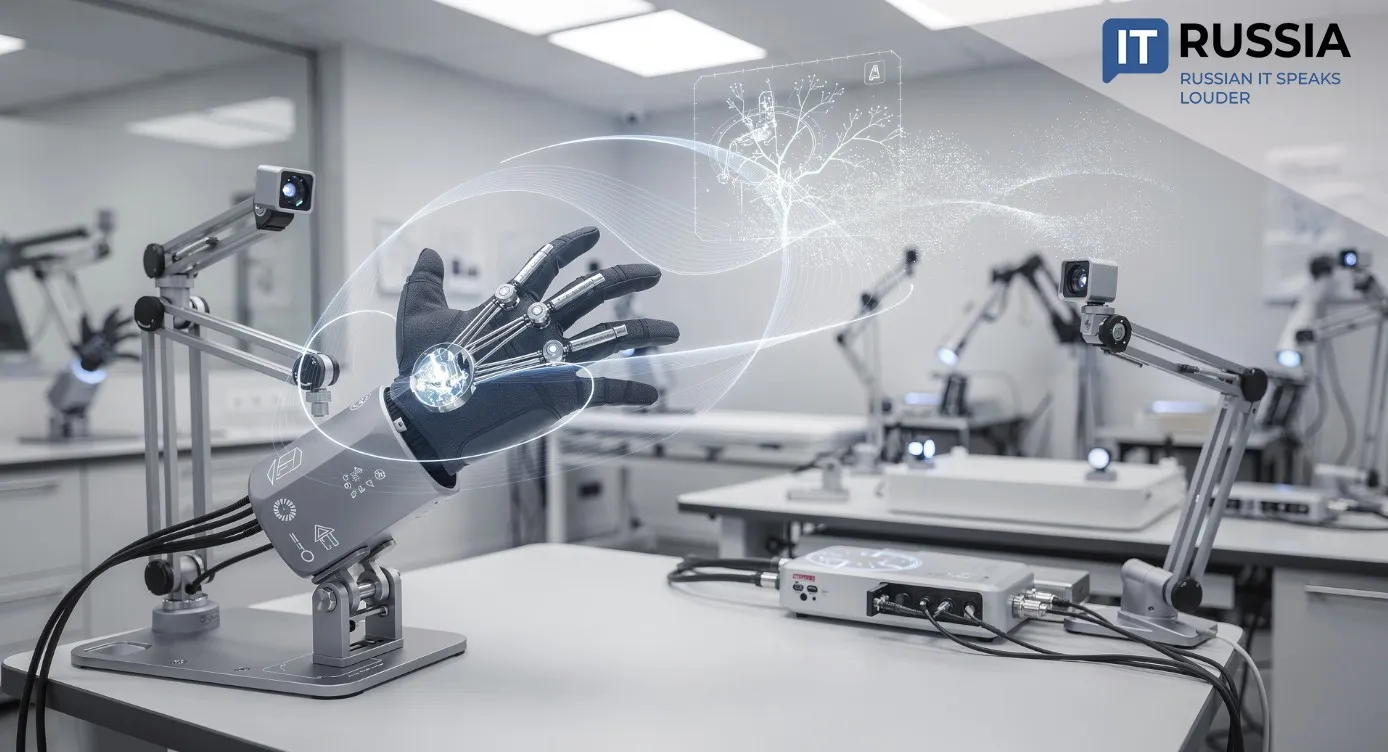

Russia’s engineering software market is now valued at approximately 50–55 billion rubles, equivalent to about $600–660 million, with annual growth near 20 percent. Oil and gas companies allocate between 5 percent and 15 percent of their IT budgets to software and neural network solutions. Adoption of domestic tools such as KOMPAS-3D and T-FLEX CAD is expanding, alongside specialized modeling systems. AI is applied to seismic and core analysis, drilling and production optimization, predictive maintenance, and industrial safety monitoring.

Embedding AI into Core Operations

The demand for systemic transformation is also driven by the increasing technological complexity of oil and gas extraction.

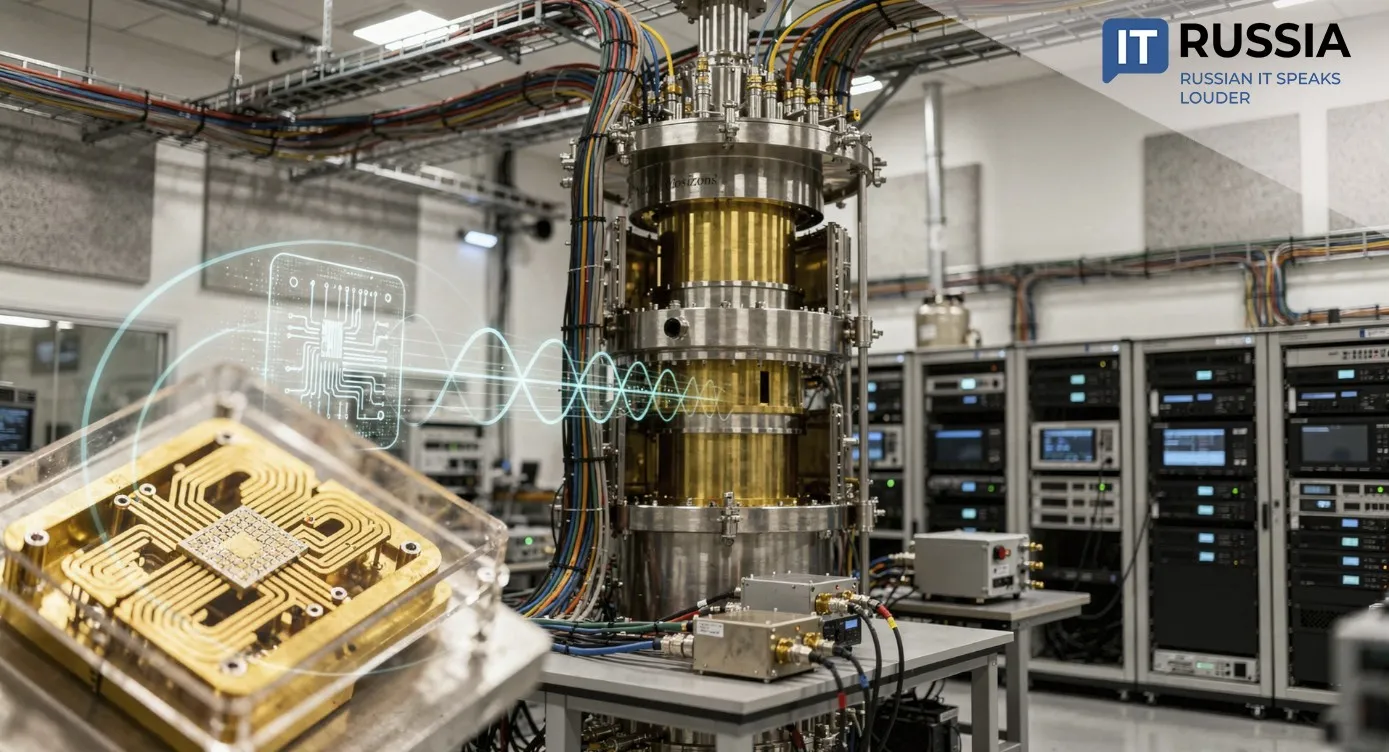

Industry experts note that the AI solutions market is developing faster than traditional engineering software. It is also transitioning more quickly from pilot deployments to early-stage industrial implementation. According to data published by the Ministry of Energy, the accumulated annual economic impact from AI deployment in the oil and gas sector reaches approximately 700 billion rubles, or about $8.4 billion. Projections indicate that between 2025 and 2040, the cumulative effect could total 5.4 trillion rubles, roughly $65 billion.

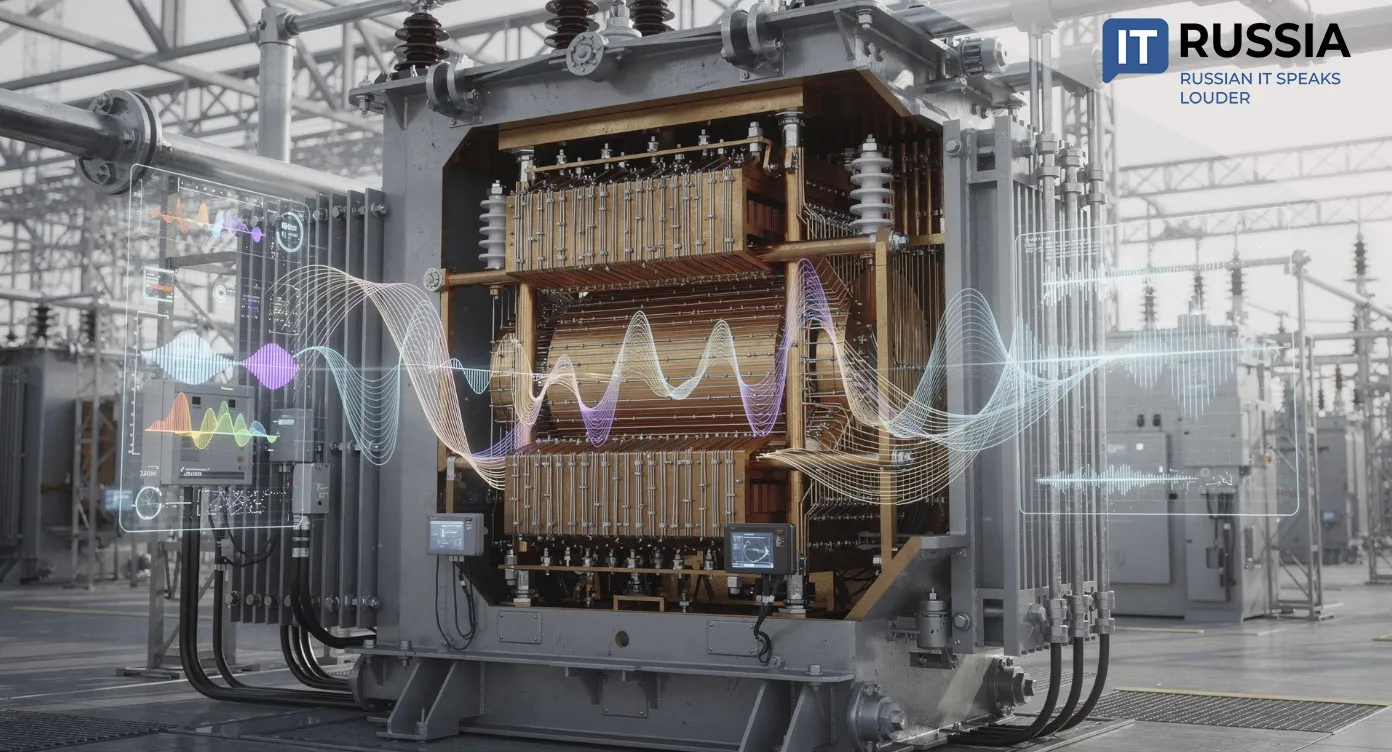

A notable shift has occurred since 2024. Earlier adoption of domestic solutions was largely reactive and driven by necessity. Today, the objective is broader: building full-scale technological ecosystems. Companies are prioritizing operational sovereignty and technological stability. Government programs and budget funding have supported the transition. Russian IT solutions are expanding across critical industries, including metallurgy, oil and gas, and power generation. The number of projects, the scope of deployments, and investment volumes have reached new levels. Fragmented initiatives are consolidating into structured digital transformation strategies.

By 2025, more than two-thirds of facilities within the critical information infrastructure of Russian enterprises had migrated to domestic software. In the power sector, this figure exceeds 90 percent.

Beyond software development, the market signals a need for highly qualified specialists in narrowly focused IT disciplines.

Observing the Process

Migration to Russian CAD platforms and engineering systems is facilitated by vendors such as Softline, which assist oil companies in transitioning to nanoCAD while maintaining established engineering standards.

The Russian IT vendor Inferit, part of the SF Tech cluster within Softline Group, and system integrator Platformix have signed a cooperation agreement aimed at strengthening their market positions and advancing national technological sovereignty. Together, the partners will design and deploy integrated solutions for corporate and public sector clients, aligning with Softline Group’s strategy.

Platformix is one of Russia’s largest system integrators. The company focuses on scalable solutions for building corporate information infrastructures. Its expertise enables delivery of complex integration projects across the entire lifecycle, from audit and system design to deployment and technical support.

Investment growth in domestic software and AI is expected to continue. Double-digit annual growth rates are projected to remain in the double digits over the next three to five years. Cross-industry platform solutions are also likely to emerge, extending beyond oil and gas into adjacent industrial sectors.