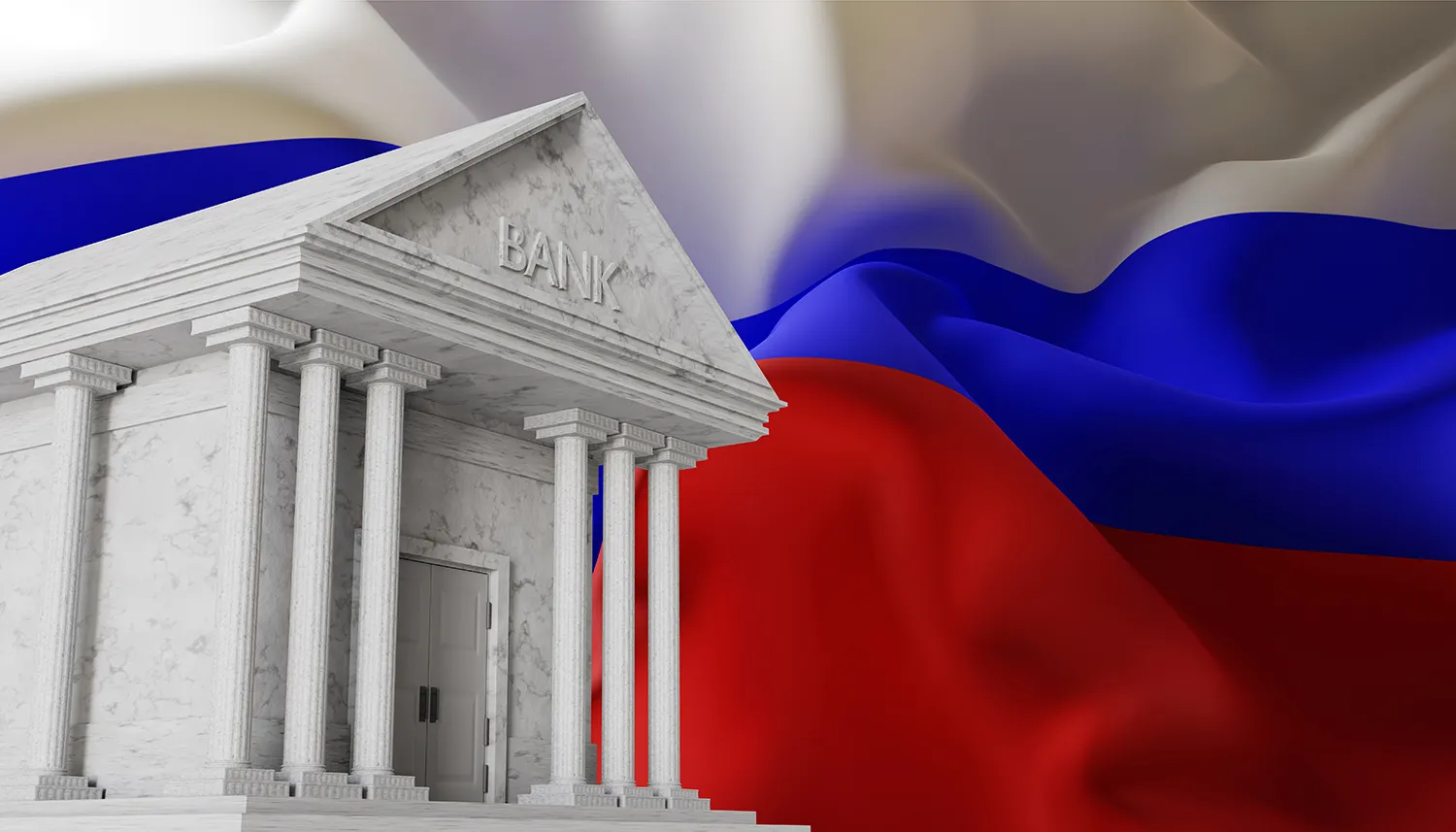

Russia Embarks on Monetary Reform with Digital Ruble for Federal Budget

Starting this fall, Russia’s federal budget will incorporate the digital ruble—a third form of the national currency—marking a major milestone in the country’s digital financial transformation.

Key Reform Details and Timeline

On August 10, Federal Law No. 303 on the digital ruble takes effect, laying the groundwork for its adoption across Russia’s public financial system. Starting in October, select federal transactions will begin processing through special digital accounts managed by the Federal Treasury. By January 1, 2026, all federal operations will be required to use these accounts. From July 1, 2027, the requirement will extend to regional and municipal budgets, as well as extra-budgetary state funds.

The digital ruble is expected to support pension payments, salaries, and social benefits in the near future. Citizens will be able to pay for goods and services using a universal payment code, even without internet access. All digital ruble transactions will be free for end users. Banks will be required to support the universal QR code by September 1, 2026. For businesses, transaction fees will be lower compared to current non-cash payments.

Financial System Impact and Transparency Gains

Each digital ruble transaction is recorded in a centralized system, reducing the risk of corruption and misuse of public funds. Operational costs will decline thanks to fee-free transfers between budget accounts and streamlined payment processing for contractors.

The legislation also incentivizes development of platforms and services compatible with the digital currency issued by the Bank of Russia (CBDC). This accelerates the creation of a unified digital environment for government services and financial operations.

From Pilot to Full Rollout

Russia began exploring the digital ruble in 2020, enacting a legal framework in August 2023 and launching a pilot soon after. By the end of 2024, more than 12,000 users—both individuals and companies—had conducted tens of thousands of transactions. However, in early 2025, it became clear that scaling the platform required resolving technical and infrastructure challenges. As a result, full-scale implementation was rescheduled for 2026.

Law No. 303-FZ resolves legal uncertainties and introduces a structured, phased deployment plan. This gradual approach reduces risks and allows for testing and optimization at each level of the budget system.

Globally, around 130 countries are exploring or already using central bank digital currencies. Examples include Nigeria, Singapore, Malaysia, Kazakhstan, and China, which launched the digital yuan in 2021 and used it extensively during the 2022 Winter Olympics.

Strengthening Economic Sovereignty

Experts believe the digital ruble could become a core component of Russia’s financial system by the end of 2027—provided the infrastructure proves reliable, public trust grows, and technological upgrades continue.

Why is the government so invested in digital currency? First, it enables complete traceability of budget expenditures—every transaction is tagged and logged. Second, it narrows the scope of the shadow economy. Third, it reduces dependence on global payment infrastructures.

Amid sanctions pressure, Russia and allied countries are exploring alternative cross-border payment systems. A CBDC-based system could boost financial sovereignty while simplifying and speeding up international settlements. Unlike SWIFT-based systems, these transactions would be difficult for Western nations to monitor.

The digital ruble could elevate Russia’s global financial standing and widen the ruble’s international footprint.