Confidence for Export: How Russian Digital Tools Are Reshaping Oil and Gas

Russia’s oil and gas sector is undergoing a digital transformation—deploying SaaS tools, AI platforms, and remote monitoring systems to tap into complex reserves and expand its global tech footprint.

Extracting the Hard-to-Reach

At the 2024 St. Petersburg International Gas Forum, industry experts noted that nearly 60% of Russia’s oil reserves fall under the category of hard-to-recover. The state is involved in regulating these challenges, including incentivizing extraction through tax mechanisms.

Initially, wells may produce oil through natural pressure, but most Russian fields require submersible pumps and water injection systems after the early stage. With water cuts exceeding 80%, vast amounts of oil remain trapped in porous rock, pockets, and fractures. To address this, producers use hydrochloric acid treatments—but errors can clog formations, demanding costly remediation.

To mitigate such risks, many companies turn to SaaS platforms. These cloud-based applications simulate acid treatment strategies and reduce trial-and-error outcomes. Powered by aggregated data from multiple users, SaaS tools provide affordable, continuously updated solutions without massive capital expenditure.

From Digitizing Companies to Digitizing the Sector

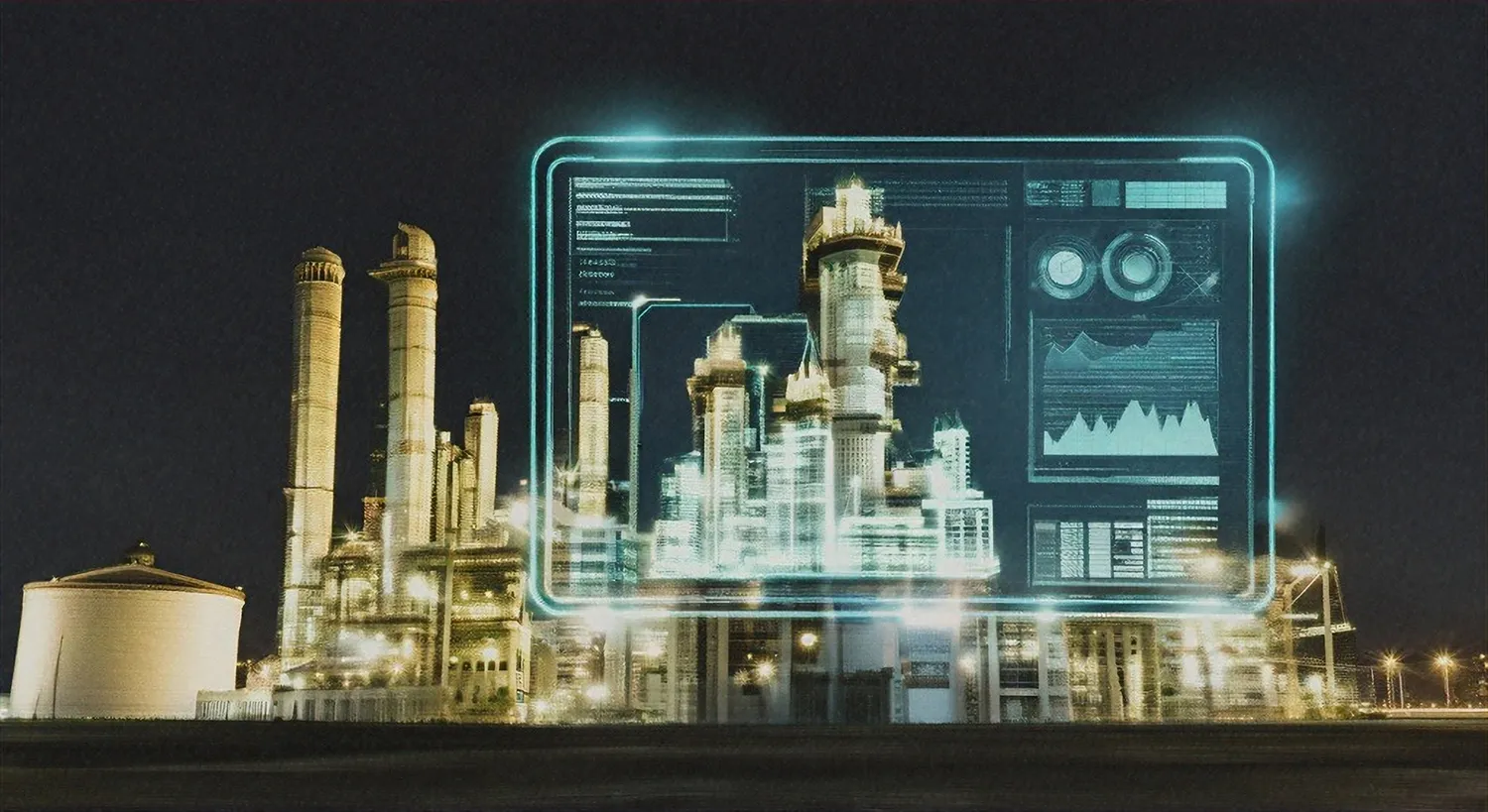

The Fourth Industrial Revolution—full automation supported by smart technologies—cannot happen in isolation. That’s why Russia is building digital ecosystems linking drones, GIS platforms, Big Data analytics, cloud tools, IIoT, augmented reality, and smart fields.

About 35% of companies now use GIS systems, 23% deploy cloud tech, and over 16% leverage Big Data. These technologies enable remote control of well operations and have become especially critical during the COVID-19 era, which forced rapid IT infrastructure adoption.

Investments Fuel Digital Momentum

The Russian energy sector is in transformation. A 2023 industry survey found that 70% of market leaders and 50% of growth-stage firms identified IT solutions as essential to staying competitive.

Within the first year of implementation, companies reported a 20% drop in operating expenses, a 25% reduction in unplanned shutdowns, and a 10% improvement in efficiency. These results led to a 17% year-on-year increase in IT investment.

Oil and gas now rank sixth among industries by IT spend, with strong demand for Russian-developed platforms. Enterprises are prioritizing domestic software for data analysis, industrial operations, and sector-specific applications.

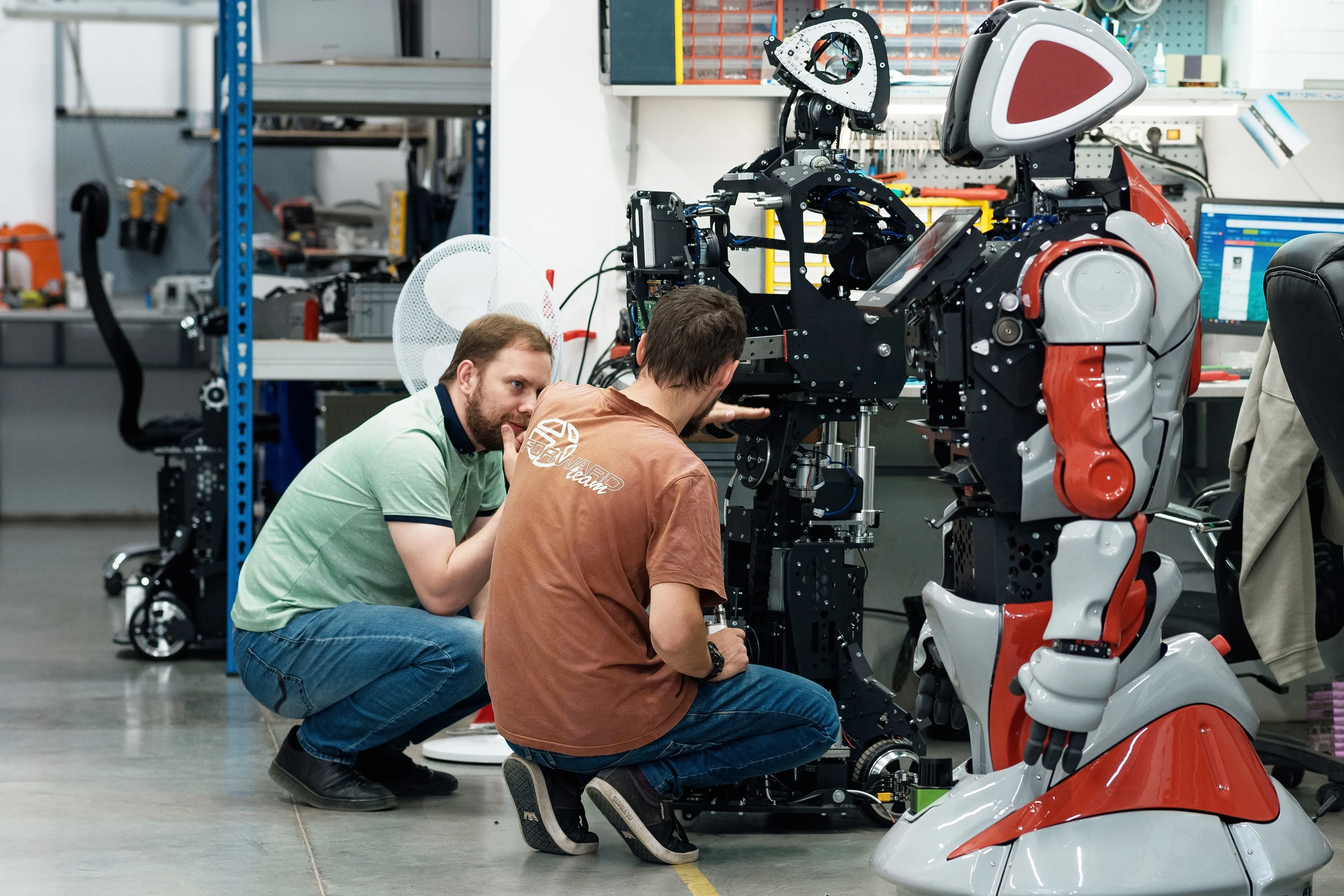

Russian developers lead in CAD/CAE/CAM engineering systems and cybersecurity—critical areas amid rising geopolitical threats. Some firms are also building their own tools, turning them into export assets.

Russian digital oil and gas solutions are gaining traction across Asia, Africa, and the Middle East. What started as a sovereignty-driven response to foreign software restrictions has evolved into a sustainable export niche with global demand.