Wooden, Iron, Digital: The Rise of Russia’s CBDC Ambitions

Russia’s central bank is moving fast on its digital ruble — a strategic tool poised to transform domestic finance, expand global trade independence, and push back against Western-controlled infrastructure.

From Cash to Code: The Digital Ruble in Action

The digital ruble is Russia’s third official form of currency, alongside physical cash and non-cash funds. Developed by the Bank of Russia, the digital ruble is undergoing pilot testing with both banks and real users already onboarded. More than a tech upgrade, it’s a financial system reboot — one driven by both internal modernization goals and growing pressure from Western financial institutions.

The platform enables peer-to-peer and business transactions, supports offline use, and is built to integrate with public services and the national budget. Full-scale deployment depends on successful testing and regulatory readiness, with a nationwide rollout expected within the next few years.

Why It Matters: Efficiency, Risk, and Reach

One of the core promises of the digital ruble is cost-efficiency. For small and mid-sized enterprises, it streamlines interbank transactions — often bogged down by liquidity issues and time delays. It also increases transparency, giving regulators new tools to monitor financial flows and fight money laundering.

For everyday users, especially in rural areas with limited bank access, offline functionality is a game changer. No internet? No problem — payments can still be processed through pre-loaded credentials.

But the transition isn’t risk-free. A centralized digital currency system presents a high-value target for cybercriminals. Ensuring ironclad security and fraud prevention is critical. Additionally, the shift could impact traditional banking. If users migrate funds en masse into digital wallets overseen by the central bank, commercial banks could face liquidity crunches that reduce their ability to issue loans.

Borderless Ambitions: Escaping the SWIFT Shadow

The digital ruble is also a geopolitical move. One of its key functions is to reduce Russia’s dependence on Western systems like SWIFT. Amid sanctions, the need for a sovereign cross-border payment mechanism is more urgent than ever. A digital currency could anchor Russia’s efforts to build an alternative transaction ecosystem.

There’s also potential for collaboration with other nations developing CBDCs, especially within BRICS. The idea of a shared digital settlement currency is gaining traction and could reshape international finance into a multipolar structure less reliant on Western gatekeepers.

To succeed globally, the digital ruble must meet international standards and win foreign trust. Without that buy-in, it risks becoming a siloed domestic tool.

From Sanctions to Sovereignty: The Big Picture

If fully realized, the digital ruble will give the Central Bank of Russia a new instrument for monetary policy — enabling more precise control of money supply, inflation management, and targeted economic interventions. This centralized oversight could raise concerns over privacy and government overreach, but transparency and legal compliance could help build long-term public trust.

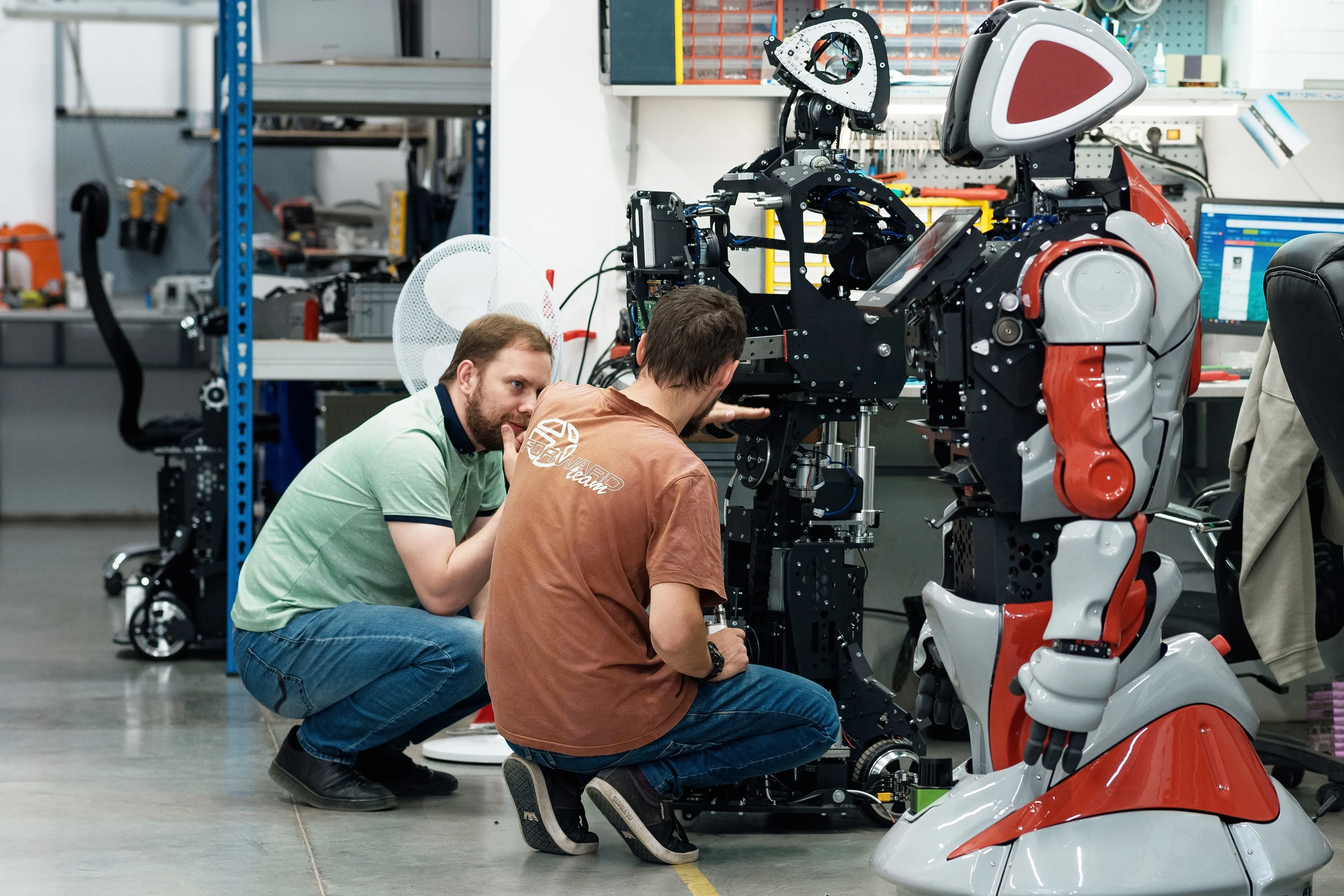

Domestically, success depends on widespread infrastructure upgrades, digital literacy programs, and real-world use cases for consumers and businesses. Internationally, Russia must align with like-minded partners seeking de-offshored, sovereign payment systems.

The digital ruble is more than a digital currency. It’s Russia’s financial moonshot — a core piece of its strategy for monetary sovereignty and global positioning in a post-SWIFT world.