Why Russian Fintech Is Poised for Global Success

Amid shifting markets and rising demand for scalable fintech tools, Russian developers are emerging as credible global players—blending technical sophistication with pragmatic market adaptation.

Scalable Expertise in Action

Russia's fintech sector is gaining traction worldwide, driven by demand for flexible digital payment tools, microfinance systems, and turnkey banking platforms. Domestically, fintech is a core priority under Russia's Financial Market Development Strategy through 2027, which emphasizes export-oriented innovation and international investment.

Russian firms—especially banks and fintech startups—offer secure, automation-friendly solutions to launch digital banks and serve unbanked or underserved populations. From full-service platforms to lightweight microfinance tools, local developers are proving they can scale across borders.

Going Global, Adapting Locally

Russian fintech is gaining adoption in Europe, Asia, and Africa. Combine, a financial planning app, is now available in the UK, France, and Spain. In Central Asia, Russian technologies power real estate transaction platforms in Uzbekistan and financial modernization efforts in Kazakhstan and Kyrgyzstan.

In Indonesia, regulators are evaluating the Russian Mir payment system. In Congo, BPC's SmartVista platform is used for interbank payment integration. These case studies illustrate Russia’s growing profile in fintech, especially in markets seeking resilient alternatives to Western providers.

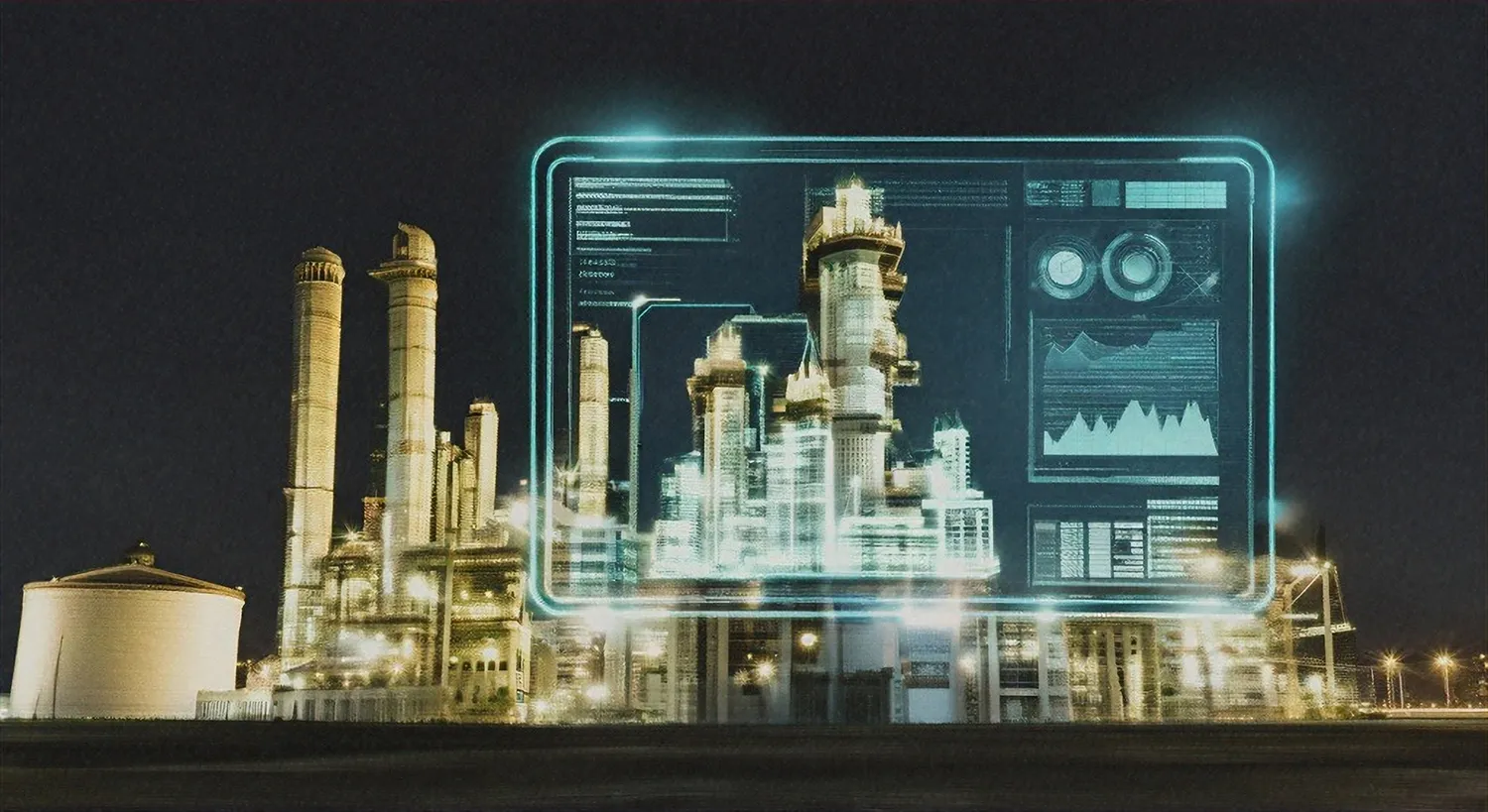

Fintech That Bridges Infrastructure Gaps

Emerging markets face legacy infrastructure limitations. Russia's mobile-first and cloud-based platforms help leapfrog these barriers—boosting financial inclusion, especially among women and youth, as highlighted by recent fintech accessibility studies.

Data privacy and regulatory compliance are key strengths. Russian fintech tools are built to align with international standards on security and consumer protection—an important advantage in increasingly regulated financial environments.

Momentum, Trends, and Global Relevance

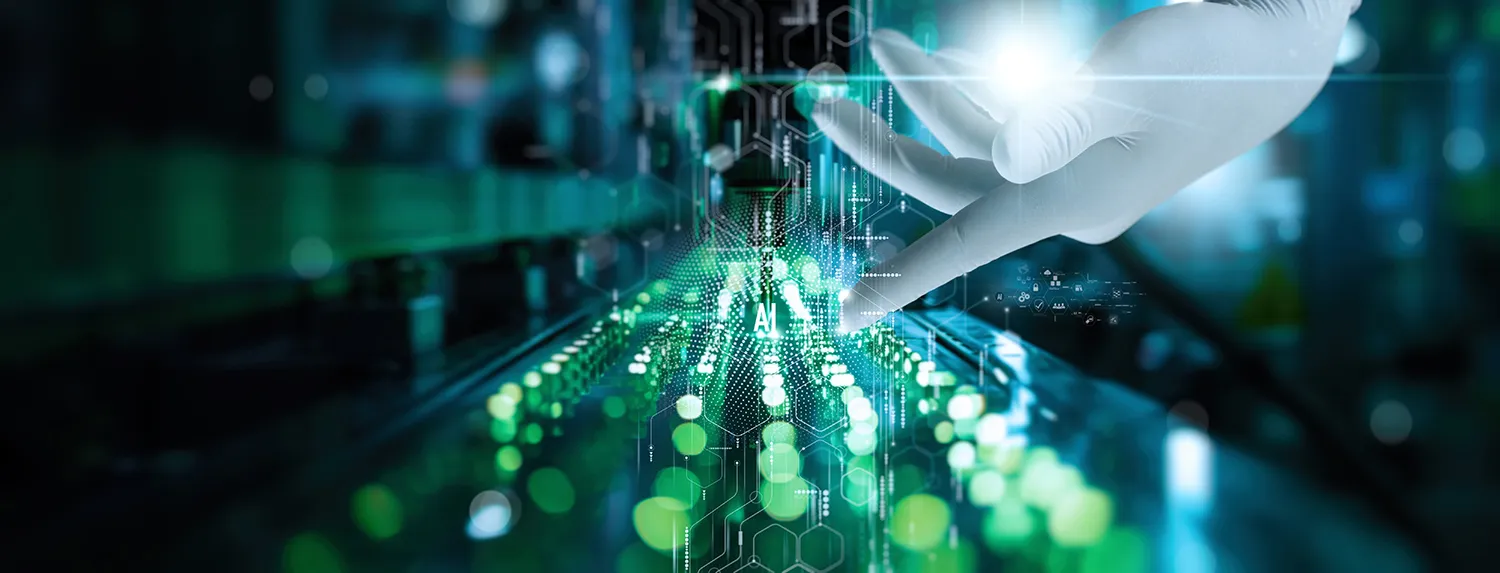

According to Smart Ranking, Russia’s fintech market grew 16% in Q1 2025 year-over-year, continuing 15% annual growth from 2024. Trends like Open APIs, remote identity verification, and AI-driven personalization are becoming central to product development.

AI is particularly impactful: it supports dynamic pricing, contextual offers, and real-time decision-making. This reduces costs while improving user experience—a value proposition attractive in both mature and emerging economies.

Interest from Africa and South Asia is growing. At Global SME Finance Forum 2025 and events like FinovateFall, Russian companies are showcasing capabilities and forming strategic partnerships.

Despite sanctions and software access restrictions, Russian fintech remains resilient. With continued innovation and growing international engagement, the 'Made in Russia' label is gaining credibility in global digital finance.